Image source: Getty Images

A £250,000 ISA sounds like a major financial milestone. But when it comes to replacing a salary, the reality is far more sobering than it first appears.

That’s because retirement outcomes aren’t determined by how a portfolio was built. They’re determined by how much income it can sustainably provide once withdrawals begin.

Sustainable income

Once contributions stop, the maths becomes remarkably simple. A portfolio either supports a given level of inflation-adjusted income, or it doesn’t – regardless of how long it took to get there.

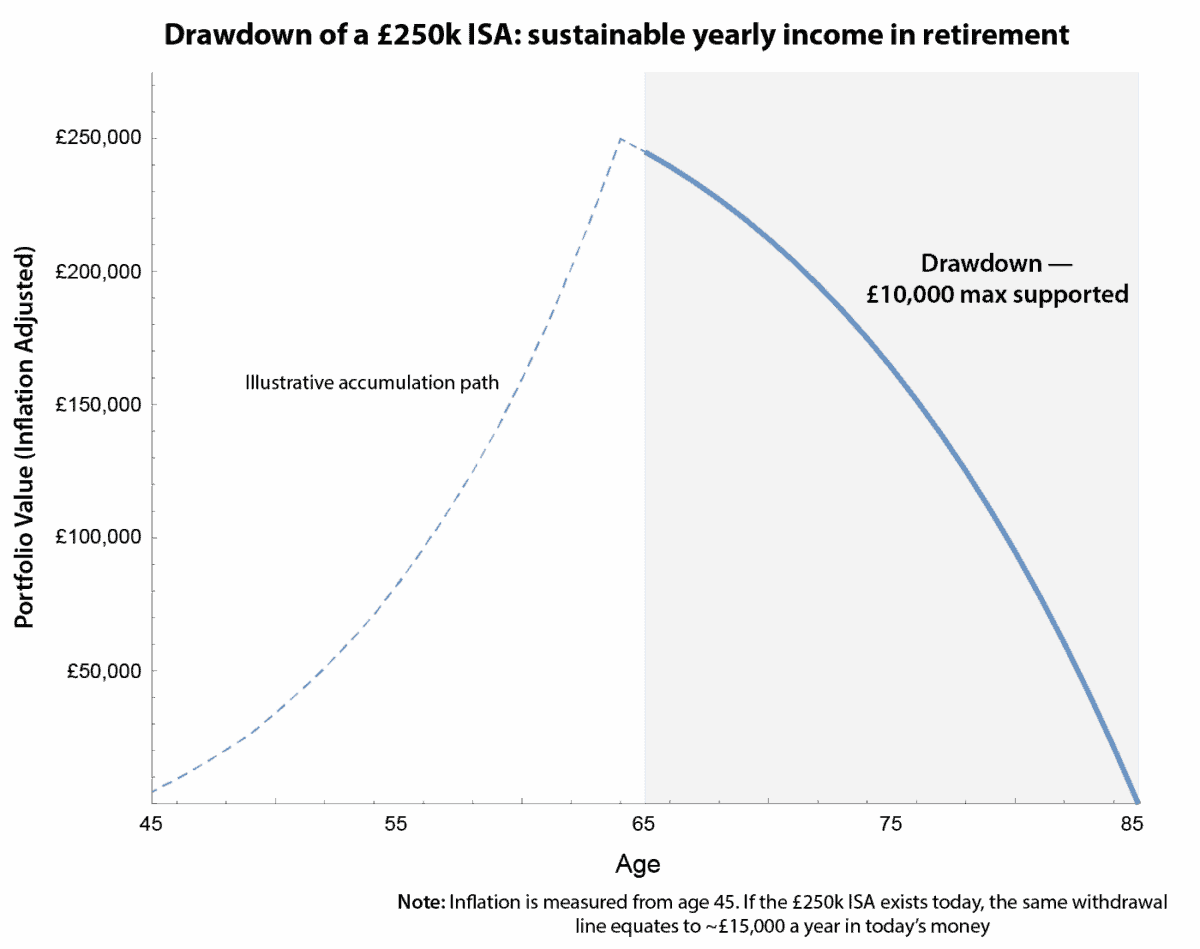

The chart below focuses only on this drawdown phase. It assumes a cautious long-term return of 4% a year and inflation of 2%, and runs the portfolio down to zero by age 85. This effectively stress-tests the maximum sustainable income over a 20-year retirement.

Chart generated by author

Under these assumptions, a £250,000 ISA can generate around £10,000 a year, or roughly £833 per month, in real terms. That may cover some essentials or supplement other income, but it falls well short of replacing a typical salary.

Allowing for market volatility or longer life expectancy reduces sustainable income to around £750 per month, while leaving a residual balance of roughly £57,000.

Inflation timing

Where investors often get confused is inflation. If you already hold the full £250,000 today, the starting capital is in place immediately, which supports income closer to £15,000 a year, or about £1,250 per month in today’s money.

Crucially, this isn’t a different withdrawal strategy. The sustainable income line in real terms is unchanged – having the capital today simply increases the equivalent income in today’s money. Prior accumulation improves flexibility, but it doesn’t change the underlying drawdown maths.

The message is clear: a £250,000 ISA is a solid foundation, but not life-changing on its own. Its real value lies in providing flexibility by supplementing pensions and spending, rather than fully replacing earned income.

A different way to look at Legal & General

When investors talk about income stocks, the focus is usually on yield. But with Legal & General (LSE: LGEN), the more interesting question is why that income exists – and why it keeps showing up year after year.

At its core, it’s a cash-recycling business. It takes in long-dated liabilities from pensions and annuities, invests against them conservatively, and steadily releases capital over time. That capital is then returned to shareholders through dividends and buybacks.

This matters whether you’re still building an ISA or already drawing income from one. During accumulation, reinvested dividends quietly do the heavy lifting. In drawdown, those same payments can reduce how much you need to sell – smoothing the journey through volatile markets.

What makes the shares stand out today is predictability. Management has committed to a modest 2% dividend growth, backed by long-term pension contracts rather than short-term market optimism. It’s not exciting, but it’s deliberate – and that’s often what income investors actually need.

Of course, it comes with risks. Sharp moves in bond yields, regulatory changes, or weaker capital generation could pressure dividends, while the high yield leaves little margin for operational missteps.

Bottom line

Legal & General isn’t about maximising returns. It’s designed to generate and return cash steadily over time, which could make the shares relevant across multiple stages of an investor’s journey. That long-term cash focus is why I own the shares.