Image source: Getty Images

Duolingo (NASDAQ:DUOL) is a growth stock that has been on a stomach-churning round trip since its IPO in 2021.

After opening at $141, it lost 50% of its value through the beginning of 2023, before surging 630% to a peak of $544 by May 2025. Since then, it has crashed 73% and is now back where it started at $142.

I bought shares of the language learning firm three times in 2025. And my holding is now deep underwater with a loss of 50%.

¡Qué desastre!

Is Duolingo now doomed in my Stocks and Shares ISA?

Checklist

When I first explored Duolingo, I wasn’t convinced. I feared this was just a buzzy, gamified language learning app that could easily be replicated.

Just because an app is popular, it doesn’t mean that translates (pun intended) into a good investment (see Snap or Pinterest). I worried that Duolingo had no durable moat.

However, one by one, it started ticking off boxes on my growth stock checklist. Below, I’ve listed some of them.

| Large market? | There are nearly 2bn language learners. Duolingo has 52m daily active users (~3% of the total). |

| Solving a problem? | Languages need daily practice. Duolingo gamifies the learning experience to keep users motivated. |

| Proprietary moat? | Its AI model is trained on billions of daily learning events. No rival has 10+ years of granular data. |

| Healthy unit economics? | The firm boasts strong profitability and free cash flow. |

| Is it innovative? | Duolingo uses AI-powered avatars to practice speaking skills in real time. |

| Visionary leadership? | CEO Luis von Ahn invented reCAPTCHA. He intends the AI-driven app to teach billions of people. |

| Optionality? | Yes. Duolingo now offers maths, music, and chess courses, as well as 40+ languages. |

On top of this, I look for something strange or distinctive in my growth companies (a certain je ne sais quoi, as it were). The company ticks this box with its bizarre Duo owl mascot and quirky social media campaigns.

Von Ahn describes the firm’s culture as “wholesome but unhinged”.

What’s gone wrong?

The company’s latest results for Q3 2025 were solid. Revenue jumped 41% to $271.7m, while the adjusted EBITDA margin expanded to 29.5% from 24.7% the year before. Paid subscribers increased 34% to 11.5m, with Asia now the firm’s fastest-growing region.

However, two things have spooked the market. One is that the firm is going to focus on “making the free version the best it’s ever been…A great free product drives word of mouth and, ultimately, subscriptions“.

Wall Street hates it when companies sacrifice near-term profits to drive long-term growth. The stock cratered 25% after the Q3 results.

In 2005, Amazon stock also crashed when CEO Jeff Bezos announced an “all-you-can-eat express shipping” service (aka Amazon Prime). Wall Street loathed this “charity project“, but it ultimately strengthened Amazon’s competitive position.

I think Duolingo’s move to improve the app’s teaching quality will eventually result in more subscriptions, which will drive earnings growth. But a slowdown in bookings obviously adds near-term uncertainty.

A second concern is a general one about AI disrupting entire software/technology categories. In Duolingo’s case, some investors fear learners will switch to ChatGPT and other free AI apps.

While this is a theoretical risk, it hasn’t happened yet, nor has a rival language app been knocked up in a week with AI-generated code. Besides, it would have to encourage habit formation to stop learners quitting, which is what Duolingo has mastered.

Personally, I think the AI threat is massively overblown. But only time will tell.

Doomed Duolingo?

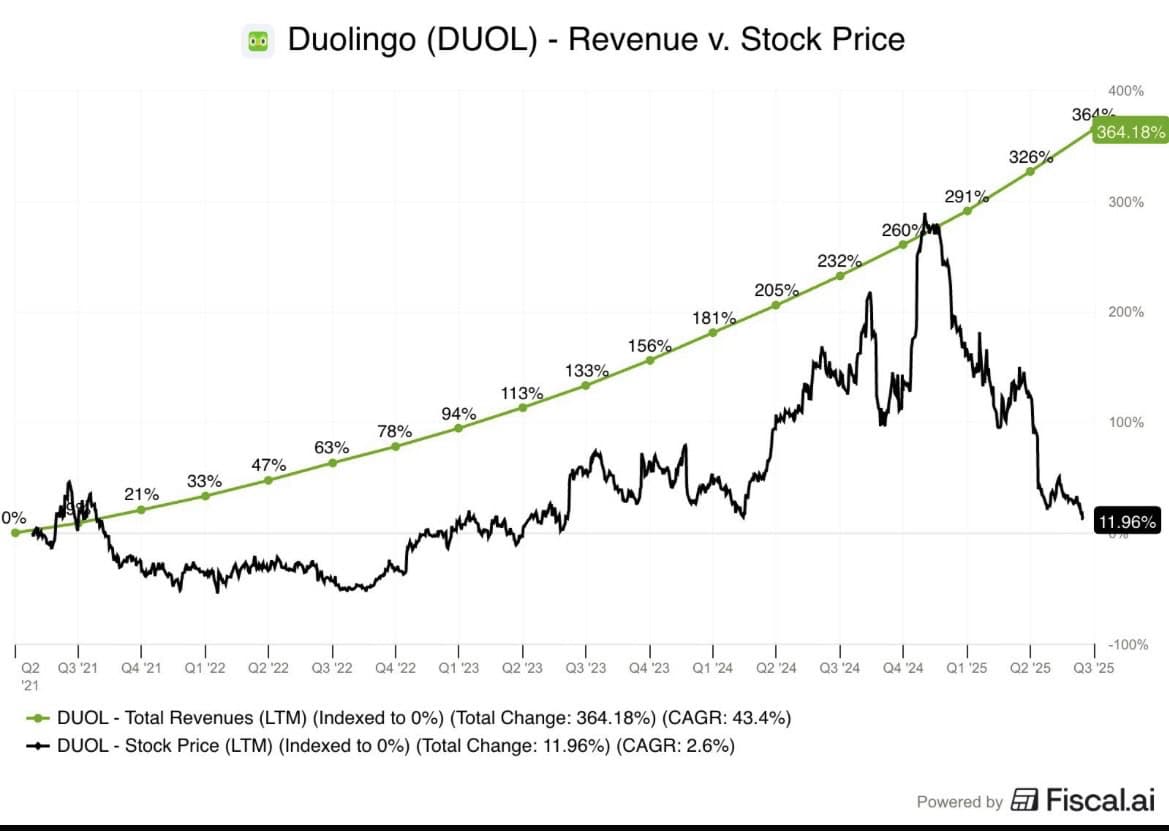

Duolingo is back at its IPO price despite growing revenue nearly four times and the number of paid subscribers almost five times since 2021. Even CNBC’s Jim Cramer, who doesn’t rate Duolingo’s prospects, now thinks the stock is “oversold“.

So there’s now a stark mismatch between the share price and underlying fundamentals. As such, I won’t be selling my shares, and I still think the stock’s worth considering as part of a diversified ISA.