Picture supply: Getty photographs

The rate of interest on UK financial savings merchandise has picked up in latest instances. However the returns I can anticipate to make from UK shares stays far superior. So I proceed to make use of most of my additional money every month to purchase FTSE 100 shares in a Shares and Shares ISA.

Don’t get me unsuitable: merchandise just like the Money ISA have a spot in my investing plan. I take advantage of one to carry cash for a wet day or to fund giant, upcoming purchases. I additionally use it to de-risk: in spite of everything, I do know that £1,000 invested in a single as we speak will nonetheless be there to attract upon 5, 10, or 30 years from now.

I’ve no such assure by investing in shares. Share costs can go up in addition to down, whereas listed firms may also go bust.

However with added threat comes additional reward. And historical past reveals me that the return from investing in British companies could make share investing one of the simplest ways to make my cash work for me. Right here I’ll present you the way.

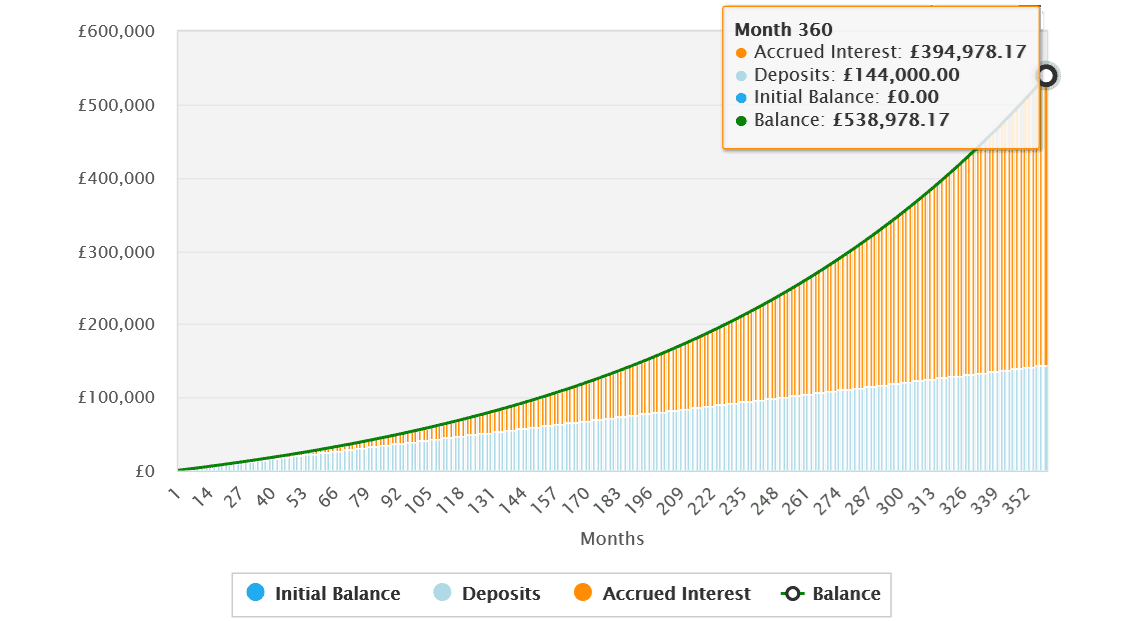

A £538K+ nest egg

Let’s say that I’ve £400 spare every month to spend money on FTSE 100 shares. This could possibly be a worthwhile technique primarily based on the 7.5% common yearly return the UK index has yielded since 1984.

If this historic fee continues I’d, after 30 years, have made a wholesome £538,978.17 for my retirement fund.

Projected returns after 30 years

A strong technique

A great way to make long-term returns with FTSE 100 shares could possibly be to purchase riskier development shares with solid-if-unspectacular firms with lengthy data of earnings enlargement.

We’re speaking concerning the likes of Diageo, Reckitt, and Coca-Cola HBC, for instance. Whereas they face vital aggressive pressures, they’ve a number of of the qualities I talked about above: modern, industry-leading merchandise, wealthy steadiness sheets, and a number of earnings streams (because of their broad geographic footprints and broad ranges of products).

Added to extra cyclical shares like HSBC and Aviva, I believe I could possibly be onto a winner.

A FTSE 100 share on my radar

Meals and family items large Unilever (LSE:ULVR) is one such inventory I’d purchase as we speak. Its potential to develop earnings even throughout powerful instances is illustrated in present dealer forecasts: development of 5% is forecast for 2024, and enlargement of seven% is predicted for 2025 and 2026.

A few of Unilever’s market-leading labels

On the draw back, income listed below are susceptible when prices abruptly soar. This was an issue in 2022 when excessive inflation prompted the underside line to fall yr on yr.

However over the long-term Unilever is ready to climate such issues. It’s because its market-leading merchandise sit excessive when it comes to each high quality and client desirability. This implies costs could be hiked throughout its territories to offset value pressures with out a big lack of volumes. So, for probably the most half, it may be relied on to develop income yearly.

I already personal this Footsie firm in my ISA. And I’ll be wanting so as to add to my holdings once I subsequent have money to speculate.