Image source: Getty Images

A Stocks and Shares ISA can be an exceptional way to generate passive income. With tax benefits boosting capital gains and dividend income, a lump sum or a regular investment can deliver a life-changing second income in retirement.

If an investor parked £20,000 in one of these ISAs today, here’s how they could eventually enjoy a roughly £1,000 tax-free cash payment every month.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Targeting £1k

There are multiple ways that individuals can target passive income in retirement.

They can draw down a set percentage from their portfolio, or switch into dividend shares that pay a regular income. They can also buy an annuity that provides a guaranteed sum for life. Or they can select a combination of some or all of the above.

I like the idea of buying dividend shares, as — over time — it can deliver a second income while still allowing scope for portfolio growth. It’s the path I plan to go down. So how large would my ISA need to be for an approximate £1,000 monthly income?

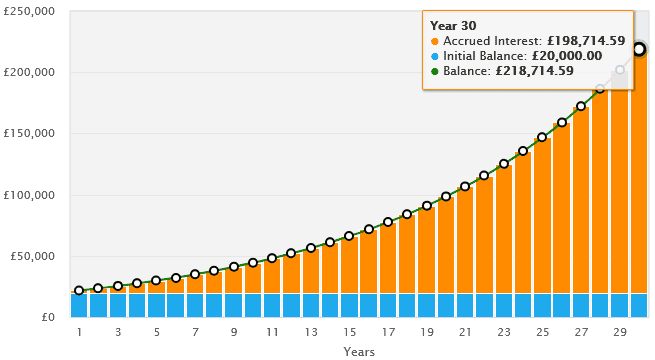

If I targeted dividend stocks with 6% yields, I’d need to have £218,715 sitting in my portfolio when I retire. That would provide me with £1,094 each month.

To achieve this with £20,000 in my ISA, I’d have to target an average annual return of 8% over 30 years.

But how realistic is this sort of return? ‘Very’ is the answer, if the long-term performance of the stock market’s anything to go by.

Robust returns

| Stock Market Index | 10-Year Average Annual Return |

|---|---|

| FTSE 100 | 6% |

| S&P 500 | 11.7% |

| AVERAGE | 8.9% |

As you can see, someone who invested in UK and US blue-chip shares would have enjoyed a near-9% annual average return over the last decade.

History isn’t always a reliable guide to future investment gains. But the broader stock market has, time and again, proved its ability to rebound from crises and deliver powerful returns over time.

An investor today could target a large income by investing in individual shares and buying an exchange-traded fund (ETF). The iShares S&P 500 ETF (LSE:CSPX), for instance, is worth considering as a direct way to harness the S&P 500’s brilliant long-term returns.

This is a fund I hold in my own portfolio. By spreading my cash across hundreds of US shares, I can capture the enormous growth potential of tech shares (like Nvidia and Apple) while also diversifying to mitigate risk.

Just under a third (31.6%) of the fund is dedicated to information technology companies. The remainder is spread across multiple sectors including financial services, consumer goods, communications and healthcare.

By reinvesting dividends, this fund uses the power of compounding — earning a return on all my past returns — to supercharge long-term growth as well.

Funds like this can deliver poor returns during economic downturns. But over time, they’ve been great ways to unlock a healthy income for retirement.