Image source: Getty Images

With shelter from capital income and dividend taxes, the Self-Invested Personal Pension (SIPP) can be a real game changer for targeting a long-term passive income.

In this respect, it has similarities to the Stocks and Shares ISA. However, this financial product has an added bonus: tax relief, which is paid at the following rates:

- 20% for basic-rate taxpayers

- 40% for higher-rate taxpayers

- 45% for additional-rate taxpayers

These tax savings and tax relief give share investors an incredible advantage to build wealth. With more capital to invest, individuals can speed up the compounding process and grow their wealth faster over time. An added bonus is that 25% of the SIPP can eventually be withdrawn free of tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Put simply, this means someone who invests less than £250 a month could realistically aim for a £2,000 monthly second income by the time they retire.

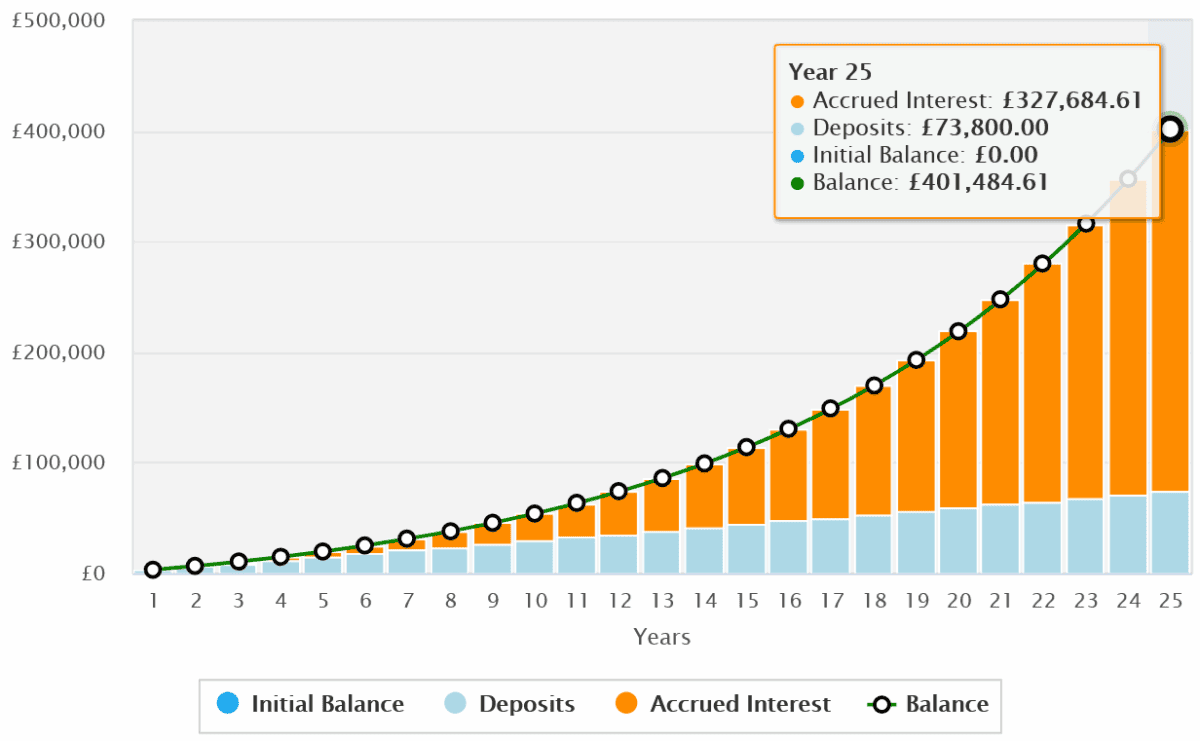

Targeting a £400k pension

A popular passive income strategy with SIPP users is to invest in dividend-paying shares.

An investor going down this route would need a pension pot of £400k for an income of £2k a month. That’s assuming they invest in 6%-yielding dividend shares. Higher-yielding stocks are commonly available that could reduce the needed pot size. But these shares can be riskier due to issues like sector concentration, lower growth potential, and balance sheet instability.

Share investors have many options available to them to target this £400,000 portfolio. I personally like the idea of investing in a wide range of global shares, which provides large-range growth and income opportunities. At the same time, this diversified approach also lets me spread risk.

By holding a basket of shares that replicates the MSCI World Index, an individual could target that £400k SIPP with a monthly investment of just under £250 (£246) over 25 years. That figure includes tax relief, too.

This calculation is based on the index’s 10-year average annual return of 11.2%.

Using global funds for a SIPP income

The MSCI World Index consists of 1,322 different companies. Clearly, adding this number of shares into a SIPP would require considerable effort and cost. Many of these shares would be unavailable to personal pension investors too. So this approach is clearly off limits.

Happily, though, investors can target the index with the help of an exchange-traded fund (ETF). The iShares Core MSCI World Index (LSE:IWDG) — launched in 2017 — is one such investment vehicle.

Tracking errors are common with ETFs, reflecting small gaps between the fund’s performance and that of the underlying index. These reflect items like dealing charges, trade timings, and dividend reinvestment.

However, well-managed funds substantially reduce (if not entirely eliminate) the threat of wide divergences. This iShares one has a three-year tracking error of just 1.42%, according to Morningstar.

While well diversified by sector and country, I like the fund’s high weighting of technology stocks (26.7% of the whole portfolio). Shares like Nvidia and Microsoft have significant growth potential as the digital economy rapidly expands.

Past performance isn’t a guarantee of future returns. But I feel SIPP investors seeking a large income should seriously consider global share ETFs like this one.