Bitcoin mining remains the backbone of the crypto economy. In the Asia-Pacific (APAC) region, abundant hydropower, gas reserves, and surplus electricity create opportunities and friction.

The region offers “green hash” potential yet faces high electricity costs and fragmented rules. For global investors, APAC bitcoin miners now sit at the center of debates over energy use, transparency, and capital access.

APAC Bitcoin Mining Overview

Latest Update – In July 2025, Bitdeer expanded hydropower mining capacity in Bhutan to more than 1,200MW, positioning the country as a renewable mining hub. Marathon Digital and Zero Two began operating a 200MW immersion-cooled site in Abu Dhabi, showing how advanced cooling and flare-gas integration sustain operations in extreme climates. Meanwhile, Iris Energy in Australia reported 50EH/s, signaling how APAC miners scale alongside Western peers.

Background Context – The Cambridge Bitcoin Mining Map shows that after China’s 2021 crackdown, bitcoin mining shifted across Asia-Pacific economies while underground activity in China persists. Energy data, published by Asia-Pacific Economic Cooperation, projects rising renewable penetration, creating conditions where bitcoin mining can align with decarbonization goals if policy supports it.

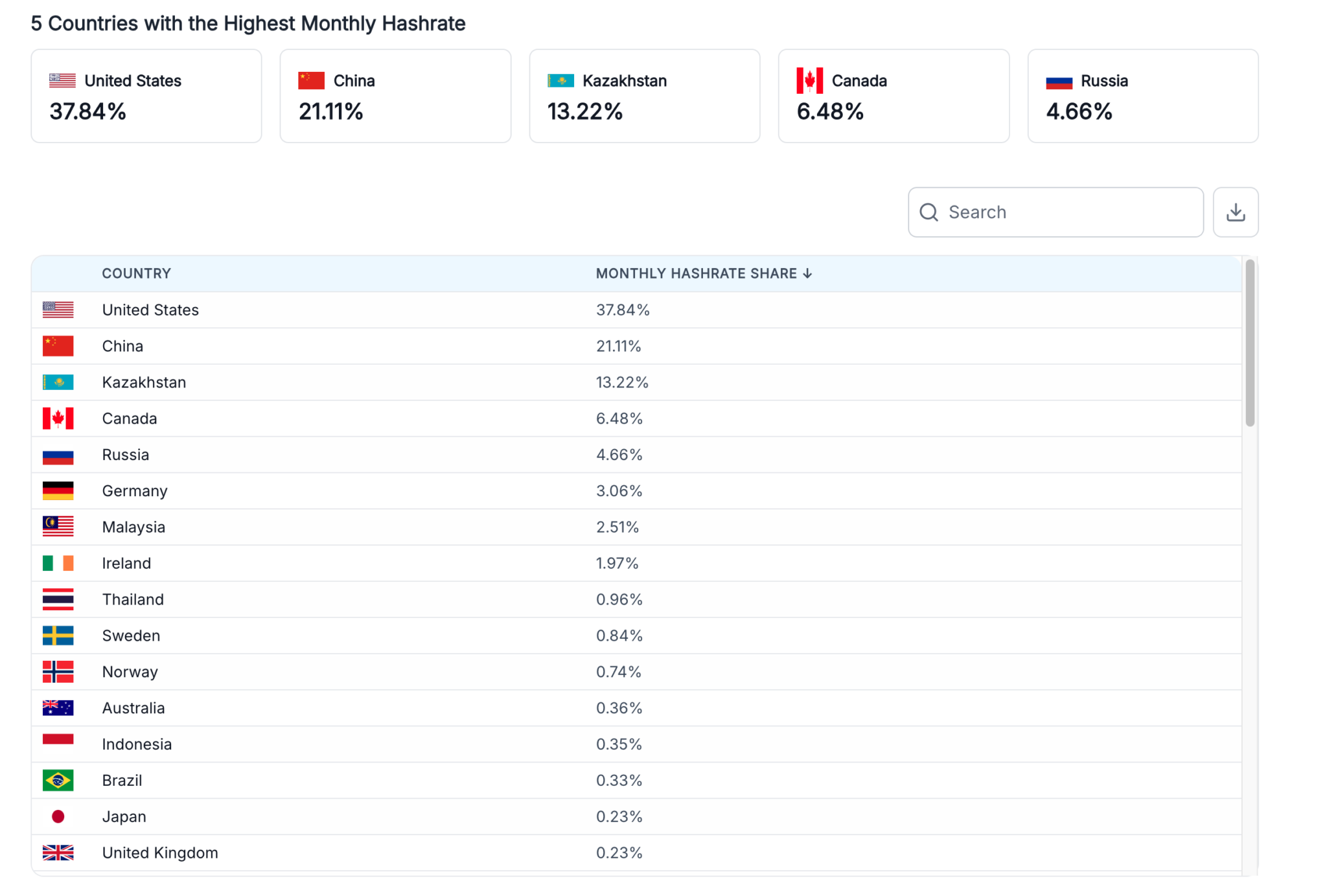

Bitcoin Mining by Country 2025. Source: World Population Review

Deeper Analysis – China remains opaque. Despite the ban, seasonal hydropower in Sichuan and underground clusters persist. The Cambridge Digital Mining Industry Report 2025 warns of underreported activity in China, complicating global hash power and concentration risk assessments.

In fact, despite the 2021 ban on crypto mining, the country still accounts for more than 21% of global hashrate. This persistence is driven by underground hydropower operations in regions like Sichuan, dispersed small-scale farms that avoid detection, and local utilities quietly selling surplus electricity. While Beijing maintains a prohibition on paper, in practice, it appears to tolerate a shadow bitcoin mining industry, adding significant opacity and transparency risks to global assessments.

Japan’s high electricity prices limit domestic farms. However, firms such as SBI Crypto and GMO operate overseas, at renewable-powered sites. Domestically, SoftBank’s 300MW data center in Hokkaido illustrates how AI infrastructure overlaps with mining-scale energy loads. PTS signed agreements to supply telecom-grade hashrate over three years in Japan’s enterprise segment, indicating steady demand for stable capacity.

South Korea is exploring power-system integration. A May 2025 arXiv study suggests that monetizing surplus electricity through bitcoin mining could help KEPCO reduce debt while lowering grid losses. This model reframes mining as a grid-balancing tool rather than a burden.

Green Hash in Asia: Hydropower, Flare Gas, and Renewable Expansion

Bhutan’s hydropower expansion with Bitdeer signals how Asia can brand bitcoin mining as environmentally sustainable and attract ESG-minded capital. Abu Dhabi’s immersion-cooled site shows how flare gas and advanced infrastructure redefine efficiency in hot climates. Australia’s Iris Energy demonstrates a hybrid model by combining renewable-powered mining with AI computing, positioning itself across digital and energy markets. These cases show that Asia-Pacific bitcoin mining is growing more flexible, diversified, and sustainability-driven.

Behind the Scenes – APAC miners balance local politics and global scrutiny. Japan and Korea focus on energy integration rather than pure scale. Bhutan markets sustainability, while China’s hidden activity raises transparency concerns. The UAE and Australia leverage their energy mixes to attract institutional capital and lower marginal costs.

Broader Impact – Institutional investors demand high disclosure standards. US-listed miners win trust with SEC filings and market liquidity, while APAC firms must bridge fragmented frameworks. However, if Asian miners deliver ESG-backed transparency, capital flows could diversify more evenly between East and West.

Looking Forward – By 2026, more APAC miners could approach parity with Western peers if they combine efficiency with credible disclosure. Competitiveness will depend on rapid upgrades to next-generation ASICs, integration with renewable grids, and establishment of regional reporting standards that reduce perceived risk for global investors.

Policy Costs and Regional Risks

Data Breakdown—The CCAF 2025 report highlights hardware efficiency gains and geographic reshuffling of mining capacity. The region’s intergovernmental forum’s Energy Outlook shows how regional energy trajectories can reshape bitcoin mining’s cost base and carbon profile.

Possible Risks –

- Japan: high electricity costs cap local capacity.

- China: underground activity undermines transparency and risk assessment.

- Korea: grid integration depends on political and regulatory support.

- Bhutan and the UAE: climate variability can affect hydrology and flare-gas uptime.

- Supply chains: ASIC production remains exposed to tariffs and geopolitics.

Expert Opinion –

“The most significant risk for Asian miners remains regulatory unpredictability. Without long-term clarity, capital costs rise and global investors hesitate.”

— Cambridge Centre for Alternative Finance, Digital Mining Industry Report 2025

“Our facility in Abu Dhabi demonstrates how immersion cooling and flare gas integration can redefine mining economics in challenging climates.”

— Marathon Digital Holdings, press release

“By monetizing surplus power through mining, utilities could improve their financial health while stabilizing electricity networks.”

— ArXiv research, Bitcoin Mining and Grid Efficiency in Korea (May 2025)

The post APAC Bitcoin Mining Goes Green Despite China Underground Activity appeared first on BeInCrypto.