The difficulty of Bitcoin reaches a new all-time high, around 129 trillion, according to updates from August 2025. In parallel, the average hashprice remains close to $60/PH/s (estimates from Hashrate Index), while in the United States, hardware importers for mining face tariffs up to 57.6% on ASICs. A context that tightens margins and forces many operators to rethink their strategies.

During our qualitative monitoring of corporate communications, regulatory reports, and industry articles updated to August 2025, we found that a significant number of operators have revised their investment and procurement plans.

The analysts we consulted indicate that high tariffs and record difficulty make a slowdown in new ASIC orders more likely and a greater focus on operational efficiency. These findings are consistent with the public data and with the independent analyses available in industry literature.

Bitcoin Difficulty at 129T: meaning and context

The difficulty indicates how “arduous” it is to mine a new block: it increases as the global computing power (hashrate) grows, in order to keep the average time between blocks around 10 minutes. The peak at 129T reflects the entry of more efficient hardware and the expansion of large farms, with direct effects on the unit production costs of each BTC.

In operational terms, a higher difficulty results in lower probabilities that a single hash is winning. In this context, with the BTC price being equal, the revenues per unit of power tend to decrease.

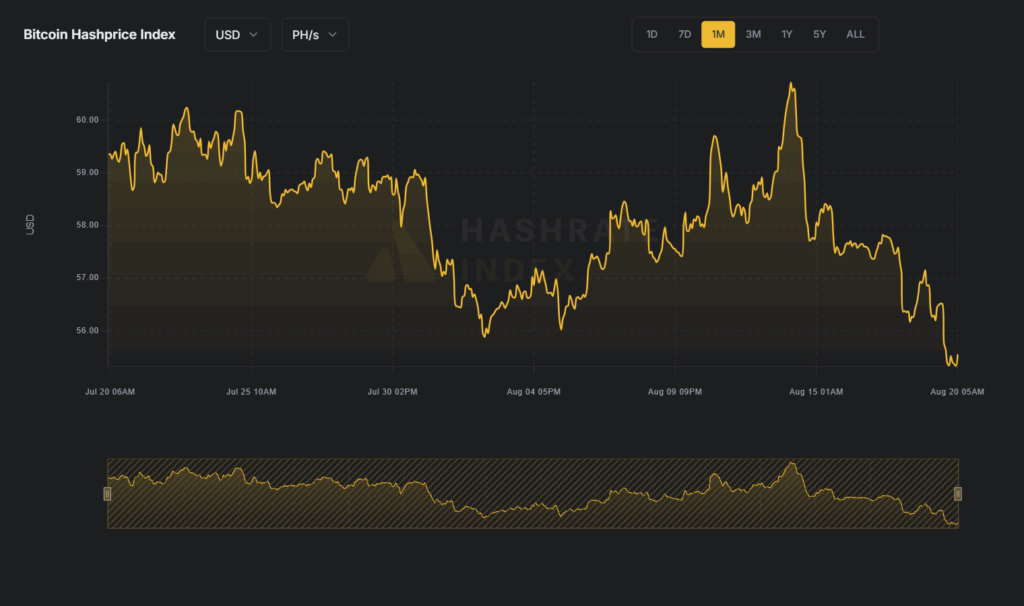

Hashprice at $60/PH/s: margins under pressure

The hashprice is the estimated revenue per unit of hashrate (for example, dollars per PH/s per day). With the difficulty at its peak, the indicator is around $60/PH/s, indicating a more compressed profitability compared to previous phases of the cycle.

This results in a compression of margins: miners with high energy costs or with less efficient machines (high consumption in W/TH) are the first to feel the impact. It should be noted that, for many operators, the break-even point shifts upwards, increasing sensitivity to fluctuations in the spot price of BTC.

Commissions decreasing: fee share below 1% in July 2025

In the month of July 2025, the fees accounted for less than 1% of the block revenues. This means that the predominant share of miners’ income comes from the fixed reward (currently equal to 3.125 BTC, consistent with the halving cycle), making cash flows more exposed to changes in difficulty and the spot price.

When the fees remain depressed, the volatility of monthly revenues tends to increase: even small deviations in price or difficulty can significantly impact overall profitability.

Tariffs on ASICs at 57.6%: impact on CAPEX and supply chain

The recent trade tightening in the United States introduces tariffs for importers of mining hardware that can reach up to 57.6%. The effect is a more burdensome CAPEX to renew or expand the machine fleet, with possible logistical delays and greater capital immobilized along the supply chain.

Two recent cases highlight the scope of the issue: CleanSpark reported a potential exposure of up to $185 million, while Iris Energy received a claim in the order of $100 million. Both companies are challenging the demands of the U.S. customs.

Practical effects of tariffs

- Increase in unit cost for the purchase of new ASICs and spare parts

- Delivery times longer and larger stocks to mitigate risks

- Expansion plans reshaped, with increasing focus on energy efficiency per watt

- Contenziosi and accounting uncertainty on potential liabilities

Prospects 2025: break-even, consolidation, and risks

In 2025, the profitability of miners will depend on three central variables: the cost of energy, the network difficulty, and the hashprice. With difficulty at its peak and low fees, the break-even point shifts higher. Possible implications include consolidation of the sector, a slowdown in ASIC orders, and increased relocation to areas with more competitive energy.

A decrease in difficulty or a recovery of the hashprice could offer temporary relief; however, structural factors – persistent tariffs and high energy costs – require deeper strategic responses. An interesting aspect is the different resilience among operators, linked to energy mix and contract structure.

The moves of the miners: efficiency, hedging, and flexibility

- Energy optimization: renewal with more efficient machines, immersion cooling, participation in demand response programs

- Supply chain: diversification of suppliers, nearshoring solutions, and renegotiation of contracts

- Hedging: coverage on BTC and instruments linked to the hashrate (e.g., specialized indices and derivatives, like those offered by Hashrate Index)

- Energy mix: greater share of renewables and use of otherwise wasted energy

Impact on the market and scenarios

The pressure on revenues could trigger a natural selection: operators with high OPEX might reduce activity or divest assets, leaving room for more efficient players. In case of an increase in the BTC price or a decrease in difficulty, margins can improve; however, visibility remains limited until tariffs and energy costs converge to more favorable levels.

Related Insights

- How Bitcoin mining works: hashrate, difficulty, and rewards

- Halving Bitcoin: what changes for miners and for the market

- Bitcoin price today: quotations and market factors

Summary

Summary: difficulty at 129T, hashprice around $60/PH/s, fee share below 1% in July 2025, and tariffs up to 57.6% on ASICs in the USA. The 2025 outlook remains challenging for miners, dealing with compressed margins and increasing CAPEX. The future balance will depend on the price of BTC, the cost of energy, and regulatory developments.

Transparency note: the data presented is based on public and updated sources (Hashrate Index, Blockchain.com Charts, Cambridge Bitcoin Electricity Consumption Index).