Image source: Getty Images

Nowadays, £10 doesn’t buy much. But it could set in motion a second income that sets you up for retirement.

A tenner a day works out at roughly £304 a month. If put to work in a portfolio of global shares, it could — based on the stock market’s long-term performance — unlock a five-figure annual passive income for your later years.

Think that’s a load of baloney? Come take a look. It could change your life.

Building a £556k portfolio

We’re so focused on low-yielding savings accounts in the UK, that the thought of making life-changing wealth for retirement is often considered a pipe dream.

Nothing could be further from the truth. Just ask the thousands of Brits who’ve made millions with Stocks and Shares ISAs.

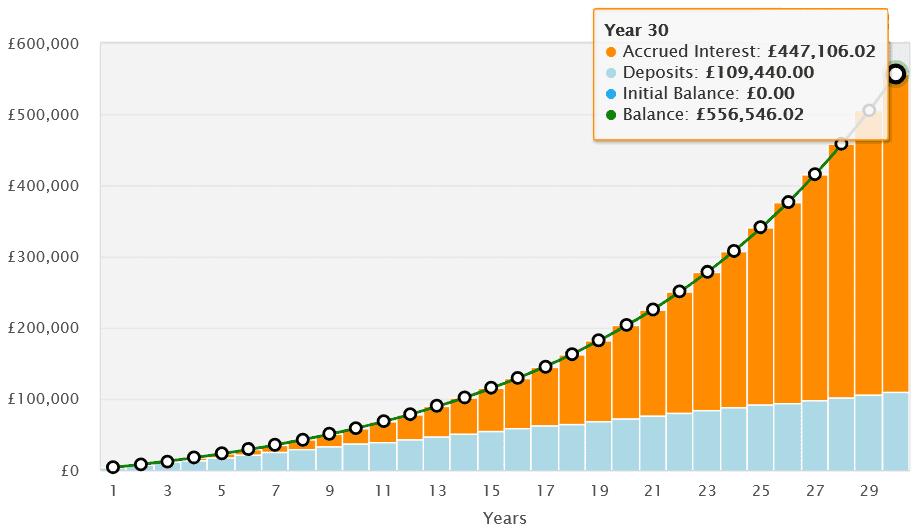

The long-term average return on stock market investing sits at around 9%. If this continues, a £304 monthly investment would — after 30 years — generate a portfolio worth £556,546.

If then invested in 7%-yielding dividend shares, an investor could target an annual passive income of just under £39k (£38,958 to be exact). Combined with the State Pension, they could enjoy a very comfortable lifestyle in retirement.

Moving up

Past performance isn’t a reliable guide to the future. And in the short term, stock markets can endure bouts of extreme volatility. In 2026, share prices could be impacted by fresh rounds of trade tariffs, for instance, or returning high inflation.

But over time, the stock market has proved time and again its ability to withstand challenges and deliver enormous returns. Take the FTSE 100, which this century alone has overcome numerous obstacles (like a global banking sector meltdown, a pandemic, and Brexit) and hit fresh records just last year.

Investors can better weather market volatility and target enormous returns by building a diverse portfolio of shares. This can be done easily and cost effectively with investment trusts and exchange-traded funds (ETF) holding a range of stocks.

Targeting US shares

Take the HSBC S&P 500 ETF (LSE:HSPX) as an example. As its name indicates, this high-power fund tracks the entire S&P 500 US share index, giving it exposure to hundreds of stocks.

This doesn’t just spread risk — some of the many industries represented on the S&P include information technology, financial services, telecoms and consumer goods. It also provides direct exposure to the world’s largest economy, and a galaxy of market-leading companies like chipmaker Nvidia, online retailer Amazon, soft drinks manufacturer Coca-Cola and card operator Visa.

As with any equities-based fund, this leaves investors exposed to market downturns. But it also provides the opportunity to build significant wealth over time, as we’ve seen.

Over the past decade, the S&P’s delivered an average annual return of 14.6%. If this continues, someone investing £304 a month in a fund like this would make an even larger nestegg than the £556k one described above.

It’s why I own the HSBC S&P 500 ETF myself. I think it could help me supercharge my passive income in retirement.