Image source: Getty Images

Retirees today receive a maximum of £230.15 a week from their State Pension. Could you imagine having to make do with that? I couldn’t. In fact, it’s a pretty scary thought, in my opinion, so I’m looking to supplement this meagre benefit with a passive income I’ve made myself.

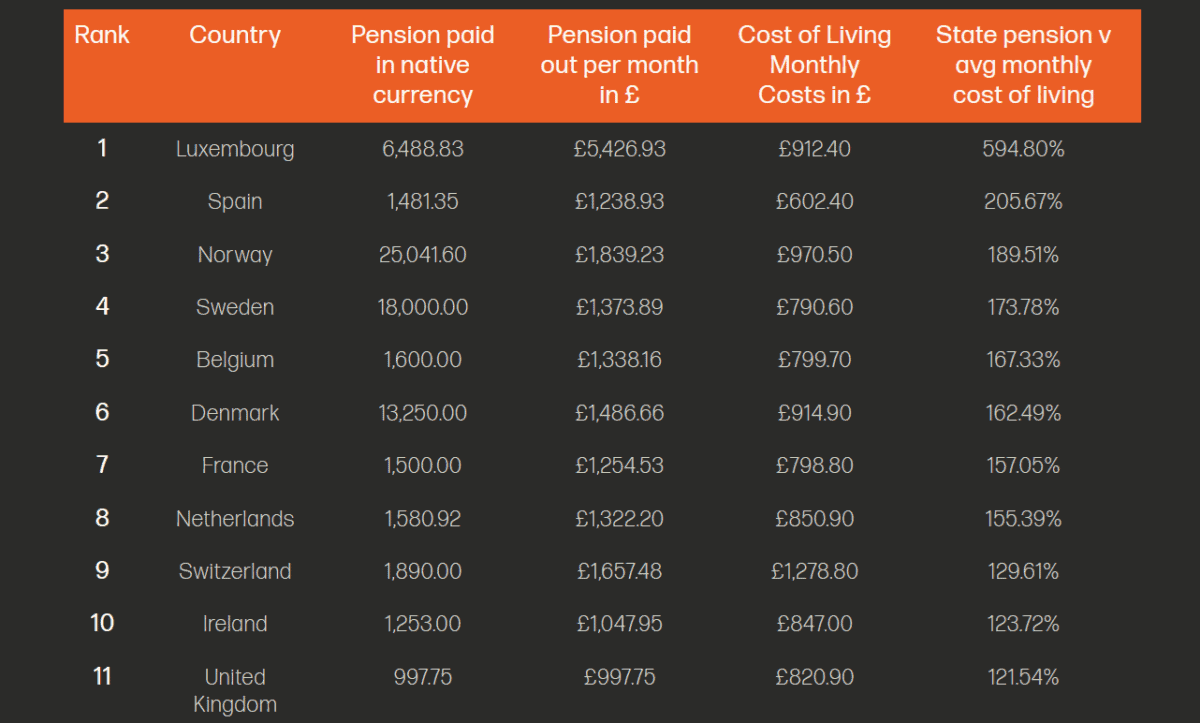

Today, the UK ranks a lowly 11th when measuring the size of the State Pension to the average cost of living, according to Almond Financial. With benefits just 21.5% above the breakeven point, this gives limited-to-no wiggle room for luxuries or to cover possible emergencies.

As Britain’s public finances worsen and the elderly population rockets, I’m not expecting things to get any better. And that’s frankly depressing. If you’re like me, you’ll be hoping to treat yourself and your family, not scrape around to afford the basics.

Targeting a £3,568 income

According to Pensions UK, the average single person requires a £43,900 passive income to retire comfortably in the UK. That equates to roughly £3,658 a month.

That’s not a small amount of money. But with a well-diversified portfolio of stocks, investment trusts, and funds, I think it’s a very achievable target.

Let’s take a ‘worst-case-scenario’ approach and completely disregard the State Pension from our calculations. It’s likely that future pensioners will still get some form of state benefit. But given the massive pressures of a rapidly ageing population and ballooning public debt, removing this is perhaps a prudent step.

To achieve that £3,658 monthly income, an investor will need a combined ISA and SIPP pot of roughly £627,000. That’s based on targeting a passive income with a portfolio of 7%-yielding dividend shares.

Chasing a 9% return

In order to reach that £627,000 target, an investor could put £500 in a combination of ISAs and SIPPs each month for just over 26 years. That’s assuming they can achieve an average annual return of 9% — a realistic target, in my book, given the long-term average of stock investing is 8%-10%.

BAE Systems (LSE:BA.) is a top stock I think could produce a large retirement portfolio over time. Defence shares are known to provide a reliable return from year to year, reflecting the essential products and services they provide. This FTSE 100 share is especially robust as well, reflecting its market-leading technologies across many different segments (from cybersecurity to submarines and satellites, and most things in between).

Like any stock, there are certain company- and industry-related threats investors need to be aware of. Supply chain issues remain a problem for the blue-chip stock, as is high competition for major contracts.

But on balance, I think investors can expect strong returns as defence spending increases in key markets. The UK, for instance, plans to spend 2.5% of GDP on defence by 2027 and 3% in the next Parliament, up from 2% today.

Investing in shares is never a sure way to build wealth. But history shows that generating enough money for retirement with a diversified stocks portfolio is very achievable. It’s why I put any spare cash I have at the end of the month in my own ISA or SIPP.