Image source: Getty Images

After spending a lifetime at work, we all hope to enjoy the kick back and enjoy the fruits of our labours. But exactly how much passive income will we need to live comfortably? This can vary substantially from person to person.

What is clear, however, is that the amount required for a good standard of living in retirement is rising steadily over time. It means that making the right financial decisions when planning for later life is becoming increasingly important.

The good news is that investors today have more opportunities than ever before to hit their retirement goals. Here’s how I’m confident of achieving a luxurious retirement.

The target

As I mentioned, the exact amount a person needs in later life will vary, depending on factors like their retirement goals, where they live, and their relationship status.

Yet it’s worth considering what the Pensions and Lifetime Savings Association (PLSA) says the average person needs for a comfortable retirement to get a rough ball park estimate.

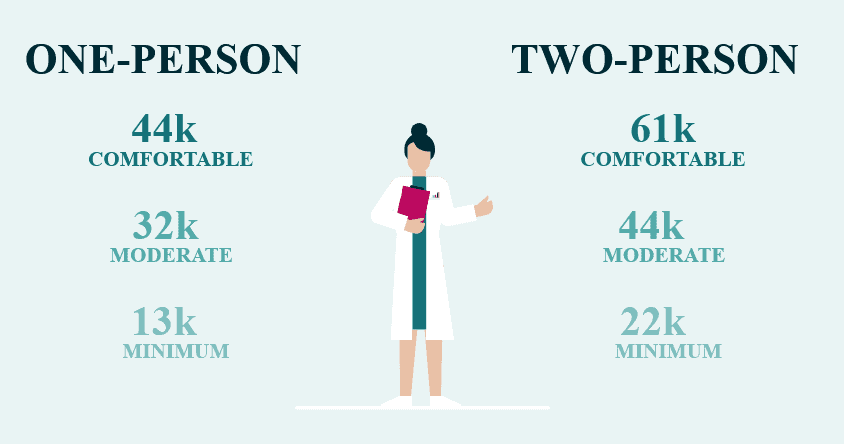

Its latest research shows that the average one-person household requires a £43,900 yearly income for a comfortable lifestyle. This level of income would provide for essentials and extras like a a healthy budget for food and clothes, a replacement car every three years, and a two-week holiday in the Med and frequent trips away each year.

The figure for a two-person household is £60,600.

A £38k+ income

There are many paths individuals can take to hit that goal. They can invest in property, develop a side hustle, or put money in dividend- and capital gains-generating shares, for instance.

I’ve personally chosen to prioritise investing in global stocks to make a retirement income, with some money also put aside in cash accounts to manage risk. With an 80-20 split across these lines, I’m targeting an average annual return of at least 9% on my share investments and 4% on my cash over the period.

Let me show you how this works. With a monthly investment of £400 in shares and cash, I could — if everything goes to plan — have a £641,362 nest egg to retire on.

If I then invested this in 6%-yielding dividend shares, I’d have an annual passive income of £38,482. Added to the State Pension (currently at £11,975), I could easily achieve what I’ll need to retire in comfort.

Taking the US route

Of course, investing in shares is riskier than putting all my money in a simple savings account. However, funds and trusts like the iShares Core S&P 500 UCITS ETF (LSE:CSPX) can substantially reduce my risk while still letting me target the strong long-term returns the US stock market can provide.

Remember, though, that performance could be bumpy during broader share market downturns.

This exchange-traded fund (ETF) has holdings in all the businesses listed on the S&P 500 index. As well as providing me with excellent diversification by sector and region, it gives me exposure to world-class companies with market-leading positions and strong balance sheets (like Nvidia and Apple).

Since 2015, this iShares fund has provided an average annual return of 12.5%. If this continues, a regular investment here could put me well on course for a healthy passive income in retirement. It’s why I already hold it in my portfolio.