Image source: Getty Images

The Self-Invested Personal Pension (SIPP) is — like the Individual Savings Account (ISA) — an effective product for building a pot of cash for retirement.

Like a Stocks and Shares ISA, any capital gains or dividend income generated in a SIPP are shielded from the taxman. This provides investors with more capital, and therefore the means for superior exponential growth through compounding.

But that’s not all. With tax relief, SIPP investors also get tax relief from the government with which to grow their portfolio.

Here’s how even a 40-year-old with no savings or investments could potentially build a large retirement fund with a £500 monthly contribution.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Tasty tax relief

That £500 investment might not seem like a lot at first glance. At £6,000 a year, this is well below the current annual allowance on SIPPs. In most cases, this is either £60,000 or a sum equivalent to a yearly income, whichever’s lower.

But thanks to generous tax relief, the actual value of these contributions can be considerably greater.

Relief is set at the following rates:

- 20% for basic-rate taxpayers

- 40% for higher-rate taxpayers

- 45% for additional-rate taxpayers

So in effect, a basic-rate taxpayer is putting £625 into their SIPP each month by investing £500 of their own cash.

Higher-rate and additional-rate taxpayers enjoy the same £125 monthly top-up straight into their pension. The remainder is claimed back via self-assessment.

Investing wisely

A boosted monthly contribution is a huge perk for SIPP users. But as with any other financial product, the amount of wealth generated ultimately depends on the way they use their money.

Investors can buy a wide variety of shares, trusts and funds with a SIPP. Or they can simply choose to hold their money in cash.

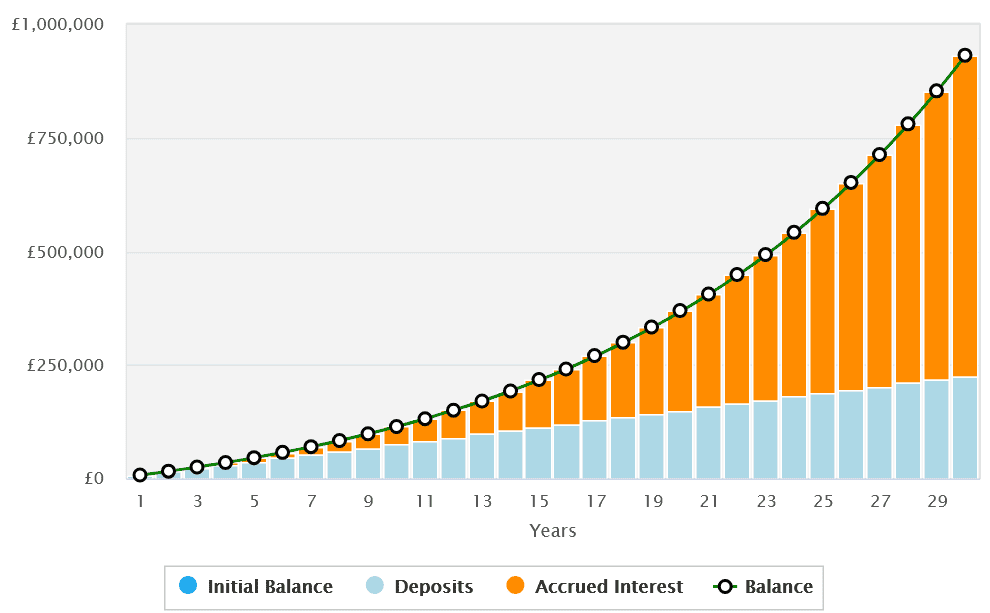

The difference on long-term returns can be considerable. Let’s say a basic-rate taxpayer was to get an average 3.5% savings rate on their cash balance. Based on a £625 monthly contribution they would, after 30 years, have a pension worth roughly £397,133.

Now let’s say they instead purchased stocks that provided an average annual return of 8%. With the same contribution over three decades they’d be sitting on a substantially higher sum of £931,475.

Getting started

There’s no right and wrong way to approach SIPP investing. The best choice for each of us is dependent on our personal investment goals and tolerance of risk.

But I believe those seeking to supercharge their retirement fund should consider investing in shares. Investing in a fund or a trust can reduce risk too by spreading capital across a basket of assets.

The F&C Investment Trust‘s (LSE:FCIT) an asset that ticks a lot of boxes for me and could be worth further research. Dating back to 1868, it has a long and distinguished record of delivering healthy returns, including 53 consecutive years of dividend growth.

Today, it holds shares in more than 400 different global companies spread across multiple sectors. Major names include chipmaker Nvidia , financial services provider Mastercard, drugmaker Eli Lilly and retailer Costco.

This diversification doesn’t shield investors from disappointing returns during downturns. But over the long term it’s proven an effective way of balancing risk management and optimising returns.

Since January 2015, the F&C Investment Trust’s provided an average annual return of 11.4%. If this continues (and that’s a big ‘if’ as it’s not guaranteed), considering a £625 monthly investment here could help investors build a gigantic SIPP a lot sooner than 30 years.