When I was young, my father would spend hours on the phone to brokers discussing share investing. I thought it sounded terribly boring but little did I know he was working towards a critical goal: building a second income.

Now, years later, I see the fruits of his labour — he lives a comfortable retirement, traveling regularly with seemingly no financial worries.

It’s a popular goal among UK investors — purchase shares in dividend-paying companies and watch the regular income flow in. For many people, this is seen as a way to supplement their pension so they don’t need to keep working past retirement age.

But how easy is it to actually make that happen? Let’s break down how much money is needed to retire early and a possible method to get there.

Image source: Getty Images

Realistic targets

Since dividends are paid as a percentage of money invested, the first thing is to work out how much is needed. For example, 5% of 500,000 is 25,000. So a £500,000 portfolio of shares with an average yield of 5% would pay out £25,000 a year.

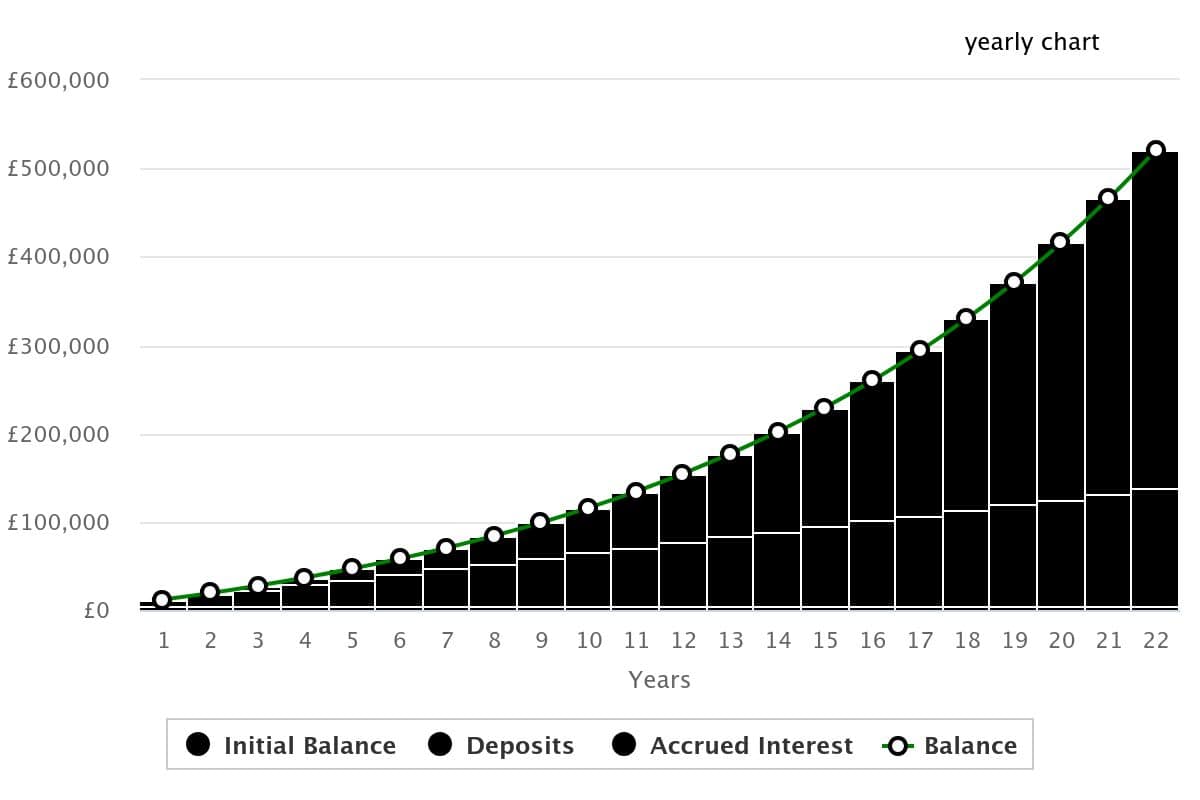

Working on those averages, how long would it take to save £500,000? Even saving £500 every month would take 1,000 months, or 83 years! Fortunately, the miracle of compounding returns would drastically reduce that timeline.

Smart investors with a well-balanced portfolio typically achieve an average return of around 10% a year. With a £5,000 initial investment and £500 monthly contributions, it would take less than 22 years to reach £500,000.

Now that’s more like it!

3 starter shares to consider

Over time, I’ve rebalanced my income portfolio several times but three shares that remain permanent fixtures are Unilever, Legal & General and HSBC (LSE: HSBA). Together, they offer a mix of defensiveness, high yield and global exposure.

As a multinational bank with a £182.4bn market-cap and 4.7% yield, HSBC embodies all three of these characteristics. Lately, Lloyds has been outshining HSBC in both growth and dividends, but the long-term outlook paints a different picture.

With well over two decades of uninterrupted payments, its dividend track record beats most rivals. And despite weak performance this year, its 10-year growth outpaces Lloyds, Barclays and NatWest.

That’s the kind of reliability I’m looking for when thinking of retirement income.

Still, past performance doesn’t guarantee anything and HSBC still faces notable risks. The key being its recent attempts to divide East and West operations — a costly effort that could cause disruption. Execution is critical here as the move has already irked investors and any profit miss could risk a negative market reaction.

But for now, things look good and I’m optimistic about the eventual outcome.

Final thoughts

When building an income portfolio, don’t just aim for the highest yields. It pays to have a foundation of defensive shares in industries that maintain demand even during market downturns.

Diversification is equally as important to reduce the risk of localised losses in one sector or region. These three companies are good examples of stocks worth considering for a beginner’s portfolio.

They can serve as a starting point to finding companies with similar characteristics, with the aim to build up a portfolio of 10-20 stocks.