Image source: Getty Images

UK stocks have largely rallied from the bottom around two years ago. However, some have been left behind. One of those stocks is Jet2 (LSE:JET2).

While Jet2 is up 137% over five years, this comparison starts from a very low base. Instead, we can actually see that the airline’s stock is flat versus where it was in December 2020 — for context, the UK was in lockdown at the time.

In other words, zero share price growth in four-and-a-half years. And that in itself is a danger. I like stocks with momentum because they’re more likely to reach fair value quicker.

Nonetheless, this lack of momentum is a risk I’m willing to take with Jet2. I’ve recently added it to my portfolio. I simply believe the stock is vastly undervalued.

Here’s what the charts say

Jet2 stock trades around seven times forward earnings. That’s not expensive for UK-listed companies and it’s not particularly expensive for airlines. The global airlines average is currently around 7.4 times.

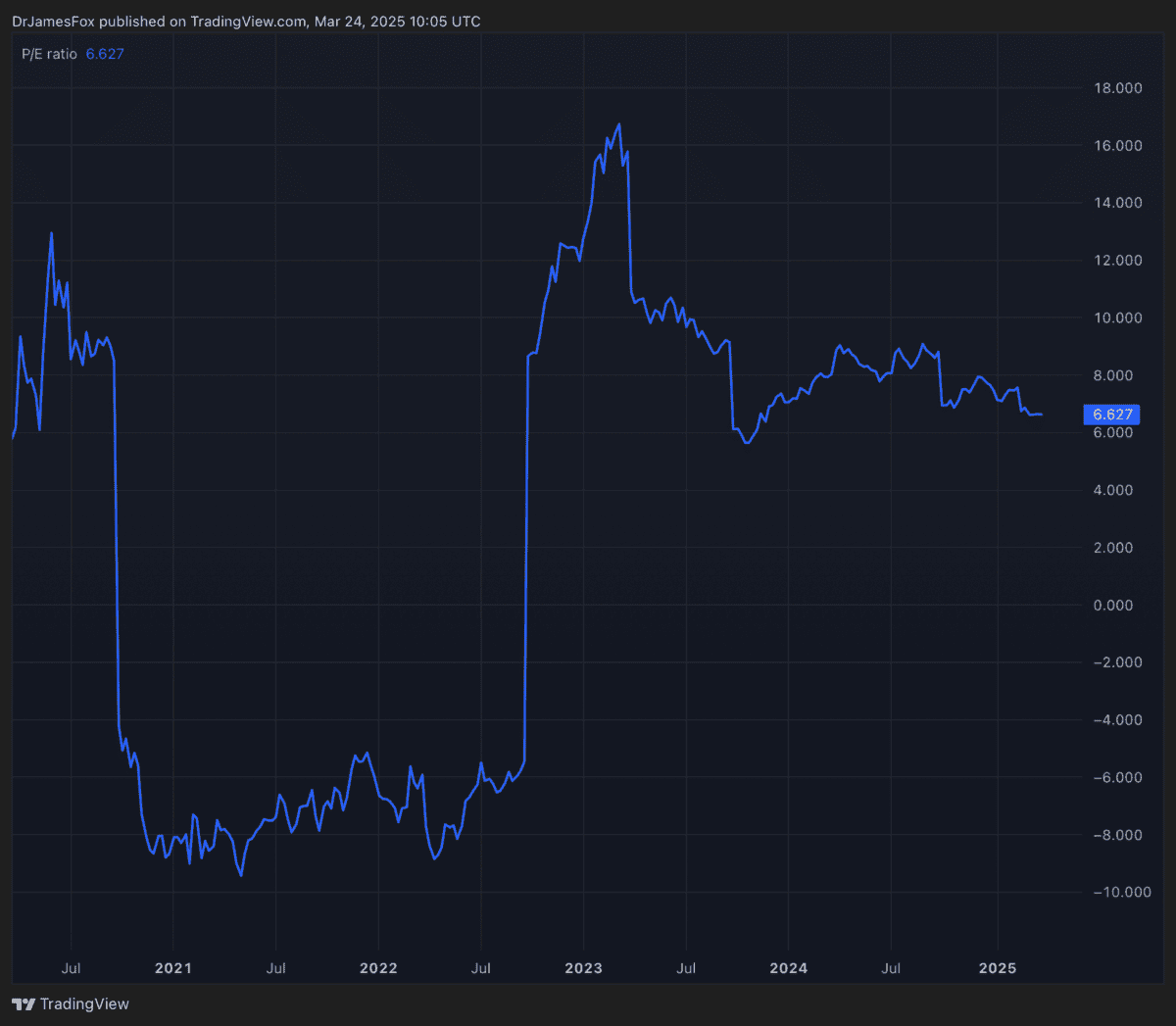

The above data shows the price-to-earnings (P/E) ratio fluctuating, but it’s back in line with where it was five years ago. We can also observe the impact of the P/E on earnings in 2020 and 2021, when it turned negative.

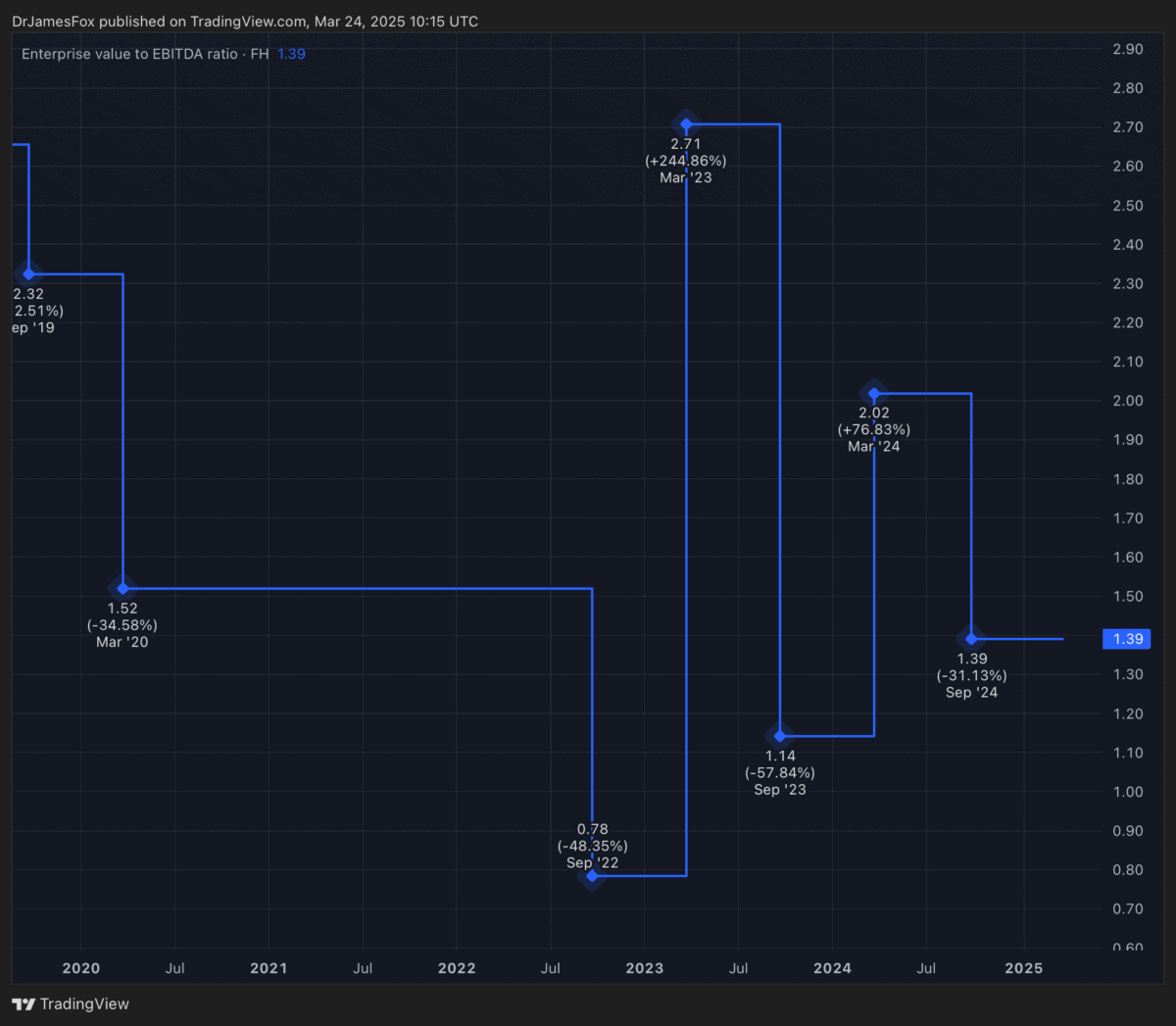

However, the real indicator of value is the EV-to-EBITDA ratio. Most airlines don’t have a net cash position, but Jet2 has £2.3bn in net cash. As a result, its EV-to-EBITDA ratio is actually rather close to one. In other words, it’s enterprise value is almost covered by just one year of EBITDA (earnings before interest, tax, depreciation, and amortisation).

By comparison, IAG trades at 5.4 times forward earnings and with an EV-to-EBITDA ratio of 3.4. The inference here is that Jet2 has been vastly overlooked.

A company overview

Jet2, the UK’s largest inclusive tour operator and a leading leisure airline, is strategically positioned for growth despite facing industry challenges. Analysts anticipate earnings growth over the medium term, supported by Jet2’s expanding market presence and investments in fleet modernisation.

The Leeds-based company has a slightly older fleet, at 13.9 years, than some of its peers. And Jet2 plans to invest £5.7bn between 2025 and 2031 to upgrade its fleet, transitioning to a majority Airbus configuration and increasing capacity from 135 to 163 aircraft. The new A321neo aircraft are expected to enhance operational efficiency with lower fuel consumption and higher seating capacity.

This investment aligns with industry norms, representing approximately 11.4% of projected revenue for 2025 and declining further as revenue grows to an estimated £8.6bn by 2027. In fact, the company’s net cash position is forecast to hit £2.7bn by 2027.

However, investors should note potential risks. Rising costs, including wages, airport charges, and maintenance expenses, could pressure profit margins. Additionally, competitive pricing in the European leisure market and a trend towards later bookings may create challenges.

Despite these challenges, Jet2’s strong market position, cash position, valuation, and strategic investments are compelling. This is why I’ll continue looking to add to my position at current prices.