Trump’s new tariff policy is poised to disrupt the U.S. Bitcoin mining industry, as China—the world’s biggest supplier of mining equipment—faces a steep 34% export tariff, putting pressure on American miners’ ROI.

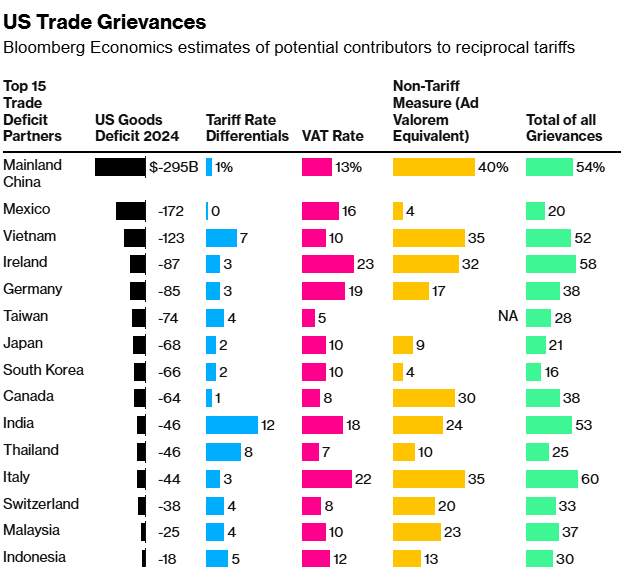

On April 2, Trump signed a sweeping executive order to impose reciprocal tariffs on every country that has tariffs on U.S. goods. The base tariff rate was set at 10%, with implementation slated for April 5. Some nations were hit with much higher rates, with Thailand and Malaysia facing 36% and 24% tariffs respectively, beginning April 9.

Source: Bloomberg

The announcement sent shockwaves through financial markets, with the crypto sector among the first to react. Bitcoin (BTC) fell from $85,238 to $82,526 by the day’s close, marking an 3.18% drop. The broader crypto market followed suit, with the total crypto market cap shedding around 4% between April 2 and April 3.

U.S.-listed crypto stocks were also hit hard. Coinbase Global slid by 7.7%, while MicroStrategy‘s stock declined by 5.6% on the day of the announcement.

You might also like: Crypto markets recoil in the wake of Liberation Day tariffs

Beyond crypto prices and stocks, the tariffs threaten to cause a huge disruption to the Bitcoin mining industry. China, still the leading manufacturer of Bitcoin mining hardware, now faces a 34% reciprocal tariff on its exports to the U.S. This poses a challenge for U.S. Bitcoin mining companies, especially considering America has become a global hub for crypto mining since China’s 2021 blanket ban on the practice.

“In recent years, the US emerged as a preferred destination—not merely due to energy costs, but because it offered legal, regulatory, and economic stability,” Gadi Glikberg, CEO of CodeStream told Bloomberg. “The newly imposed tariffs are unlikely to trigger a mass exodus. However, they may slow down or redirect future expansion plans, as miners reassess the long-term cost-efficiency of scaling operations within the US.”

With the tariffs set to take effect tomorrow, Bitcoin mining equipment suppliers are rushing to send their last shipments before the higher duties are enforced. Taras Kulyk, CEO of mining machine brokerage Synteq Digital, told Bloomberg that his company is scrambling to expedite the delivery of thousands of mining units from Southeast Asia, including Indonesia, Malaysia, and Thailand.

Amid this turbulence, mining hardware manufacturers have been preparing for a longer-term shift in operations. Bitmain Technologies, the world’s largest producer of Bitcoin mining equipment, announced plans in December to open a facility in the U.S. Another manufacturer MicroBT has struck a purchase agreement with Riot Blockchain, one of the largest U.S. miners, to leverage its American manufacturing presence.

Investors are already pricing in the long-term effects of Trump’s tariff move, with shares of multiple U.S.-listed mining companies, including MARA Holdings and CleanSpark Inc., tumbling around 10% after the announcement.

You might also like: Opinion: Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future